India Budget 2023 live | Budget will fulfil dreams of today’s aspirational society: PM Modi. The Union Finance Minister has presented the Union Budget for Financial Year 2023-24, at a time when nine States will be going to polls this year and the Modi government will be seeking a third term next year.

Table of Contents

Union Finance Minister Nirmala Sitharaman has presented the Union Budget for the Financial Year 2023-24 today, with a slew of announcements, including revision of income tax slabs, reduction of certain customs duty and sops for agriculture.

Yesterday, following the President’s address to the joint-sitting of the Parliament, Ms. Sitharaman had tabled the Economic Survey for the Financial Year 2022-23. The Economic Survey said that India’s economic recovery from the pandemic is complete and the economy is expected to grow in the range of 6% to 6.8% in the coming financial year 2023-24.

Here are the latest updates:

FEBRUARY 01, 2023 14:35

Taken many decisions to empower the middle class’: PM Modi

Hailing the middle class of India, the Prime Minister said, “In order to empower the middle class, our government has taken many decisions in the past years that have ensured Ease of Living. ”We have reduced the tax rate, as well as simplified, the process, making it transparent and fast.”

FEBRUARY 01, 2023 14:32

Increasing the limit of presumptive tax will help MSMEs grow

In this budget, along with Ease of Doing Business, the campaign of credit support and reforms for our industries has been taken forward. An additional loan guarantee of Rs 2 lakh crore has been arranged for MSMEs. Increasing the limit of presumptive tax will also help MSMEs to grow.

FEBRUARY 01, 2023 14:22

We have given emphasis on technology and new economy

In the budget we have given emphasis on technology and new economy. The aspirational India wants next-gen infrastructure in road, rail, metro, port, waterways. This time’s investment of Rs. 10 lakh crore will give a new infusion and speed to this. It will also provide opportunities for employment for the youth.

FEBRUARY 01, 2023 14:20

Repeat the success of digital payments in the agricultural sector

We have to repeat the success of digital payments in the agricultural sector as well. That’s why, in this budget, we have brought in a Digital Agriculture Infrastructure Yojana. This Budget will give a new identity to Sustainable Development, Green Growth, Green Economy, Green Infrastructure and Green Jobs.

FEBRUARY 01, 2023 14:15PM

VIKAS will bring a difference to the lives of many vishwakarmas

The budget has brought in many initiatives, which focus on training, technology, credit and market support.PM-VIKAS will bring a difference to the lives of many ‘vishwakarmas’. The government has made the world’s largest food storage scheme in the co-operative sector. An ambitious scheme to form new primary co-operatives has also been announced in the budget. From women who live in the cities to the ones on the rural areas, we have initiated many schemes to help them since 2014. In this budget we also brought in a one-time new small savings scheme, which will also aid women self-help groups.

FEBRUARY 01, 2023 14:11

PM Modi’s remarks on the Union Budget

The first budget of the Amrit Kaal will lay a strong foundation for the the resolutions for a developed India, says PM Modi in his remarks on the budget. This budget gives priority to the underprivileged, he says. This budget will fulfil the dreams of today’s aspirational society. I congratulate Finance Minister Nirmala Sitharaman on this budget, he adds.

FEBRUARY 01, 2023 12:59

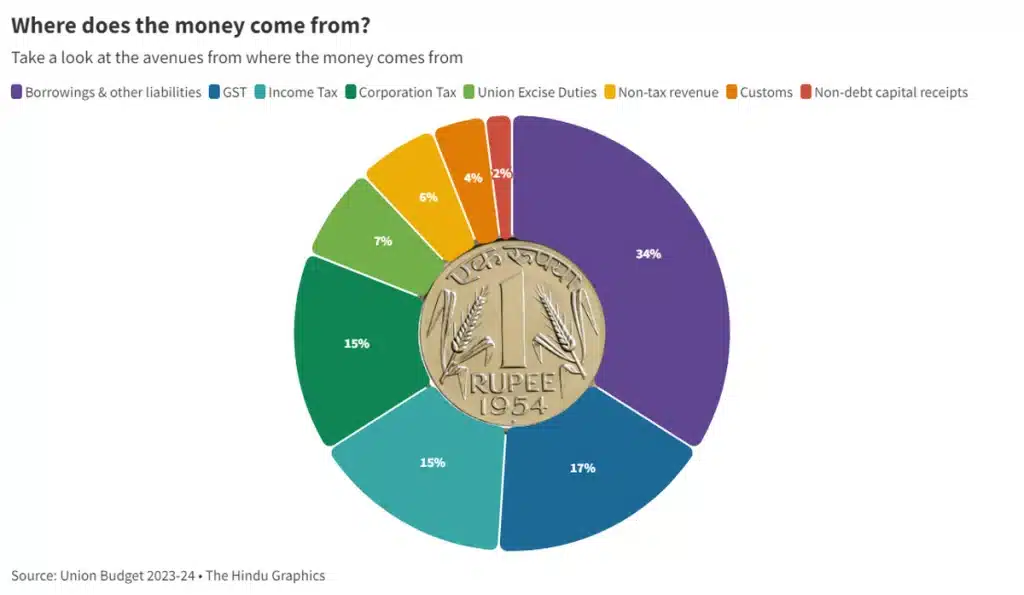

Where does the money from and where does it go?

FEBRUARY 01, 2023 12:33

Lok Sabha proceedings adjourned

Lok Sabha adjourned till 11.00 A.M. February 2, 2023

FEBRUARY 01, 2023 12:31

New tax slabs

New tax rates are as follows:

- Rs. 0-Rs 3 lakh-NIL,

- Rs. 3-6 lakhs- 5%

- Rs. 6-9 lakhs- 10%,

- Rs. 9-12 lakhs- 15%

- Rs. 12-15 lakhs- 20%

- Above Rs. 15 lakhs- 30%

FEBRUARY 01, 2023 12:30

New income tax regime will now become the default option

Revenue of about Rs. 37,000 crore in direct taxes and Rs. 1,000 crore will be foregone while Rs. 3,000 crore will be gained. The new income tax regime will now become the default option, but people will still have the option to go for earlier regime. With these words, I commend the Budget to the House.

FEBRUARY 01, 2023 12:22

Personal Income tax

- Rebate: Limit increased to Rs. 7 lakhs from Rs. 5 lakhs in new tax regime

- Six income slabs reduced to five slabs. New tax rates: Rs. 0-Rs 3 lakh-NIL, Rs. 3-6 lakhs- 5%, Rs. 6-9 lakhs- 10%, Rs. 9-12 lakhs- 15%, Rs. 12-15 lakhs- 20% and above Rs. 15 lakhs- 30%

- A person earning Rs. 9 lakh a year will now be paying just Rs. 45,000 instead of Rs. 60,000 currently. Similarly, a person earning Rs. 15 lakh will now pay only 10% of this as tax.

- The highest tax rate in our country is 42.74%, it is among the highest in the world. I propose to reduce the highest surcharge rate from 37% to 25% in the new tax regime. This will result in the reduction of the maximum tax rate to 39%.

- Pensioners: I propose to extend the benefit of standard deduction to new tax regime. Each salaried person with income of Rs. 15.5 lakh or more will benefit by Rs. 52,500.

- The limit of Rs. 3 lakh for tax exemption on leave encashment on government salaried employees was set in 2002 when government salaries were lower. It is now being raised to Rs. 25 lakh.

FEBRUARY 01, 2023 12:22

Proceeds of insurance policies

The income tax exemption on proceeds of insurance policies with very high value will be dropped. Other steps include removing the minimum threshold of Rs. 10,000 on TDS, not treating gold into electronic gold receipts will not be taxed as capital gains.

FEBRUARY 01, 2023 12:21

Startups

Entrepreneurship is vital for a country’s economic development and India is now the third largest ecosystem for startups globally. The tax benefits on their incorporation is being extended by another year and the carry forward of losses to set off against future profits will now be allowed for 10 years instead of 7 years.

FEBRUARY 01, 2023 12:18

Proposals for co-operative sector

I have a slew of proposals for the co-operative sector. New co-operatives that commence manufacturing by March 31, 2024 will get a lower tax rate of 15% just like manufacturing companies.

FEBRUARY 01, 2023 12:17

MSMEs and Professionals

MSMEs (with turnover of upto Rs. 2 crore) and Professionals (with turnover of upto Rs. 50 lakh) can avail benefit of presumptive taxation. I propose to allow deductions for expenditure incurred on payments made to them only when the payment is made.

FEBRUARY 01, 2023 12:17

Cities, towns to transition from manhole to machine-hole mode FM Sitharaman

Finance Minister Nirmala Sitharaman has indicated the Union government’s intent to eliminate manual scavenging with a plan to enable mechanical desludging in all cities and towns, which she announced during her presentation of the Union Budget for 2023-24.

“All cities and towns will be enabled for 100% mechanical desludging of septic tanks and sewers to transition from manhole to machine-hole mode,” she said.

FEBRUARY 01, 2023 12:16

India has made significant progress in many SDGs: Finance Minister

India has made significant progress in many Sustainable Development Goals (SDGs) and the per capita income has increased to ₹1.97 lahks, Finance Minister Nirmala Sitharaman said on February 1.She also said the Indian economy has increased in size from being the 10th largest to fifth largest in the world in the last nine years. According to the Center for Science and Environment’s ‘State of India’s Environment Report 2022’, the country’s overall SDG score was 66 out of 100.

FEBRUARY 01, 2023 12:15

Direct taxes

It has been constant endeavor of the Income Tax Department to make compliance smooth and easy. We intend to roll out a new Income Tax form and improve grievance redressal mechanism.

FEBRUARY 01, 2023 12:14

Customs duty relief to support mobile phone manufacturing

Customs duty relief will be extended to support mobile phone manufacturing. India’s mobile phone prediction went up to 31 crore units

FEBRUARY 01, 2023 12:13

Duty relating to Marine products

Marine products recorded the highest export growth in the past year. To further enhance exports, especially shrimp, the import duty on their feed is being reduced. This will benefit coastal communities across the country.

FEBRUARY 01, 2023 12:12

Import duty on Electric Kitchen Chimney

To rectify inversion of duty structure and encourage manufacture of electric kitchen chimneys, the import duty is being raised from 7.5% to 15%, while that on chimneys’ heat coil is being reduced from 20% to 15%.The basic customs duty on crude glycerin for use and manufacture of epichlorohydrin is being reduced

FEBRUARY 01, 2023 12:10

Relief in customs duties on import of certain parts and inputs like camera lens and batteries

I propose to provide relief in customs duties on import of certain parts and inputs like camera lens and batteries for another year to encourage mobile phone manufacturing.

FEBRUARY 01, 2023 12:09

Indirect Taxes

My indirect tax proposals will aim to promote exports, enhance domestic manufacturing and mobility, the Finance Minister says.I propose to reduce the number of customs duty rates on goods except textiles, from 21 to 13. As a result, there are minor changes in cess and levies on products such as toys, naphtha and automobiles.To further provide impetus for green mobility, customs duties are being reduced for batteries used in EV including lithium ion.

FEBRUARY 01, 2023 12:08

Estimates for 2023-24

In 2023-24, the fiscal deficit is estimated to be 5.9% of the GDP. In my Budget speech for 2021-22, I had announced that we plan to continue the path of fiscal consolidation reaching a fiscal deficit of below 4.5% by 2025-26. We will adhere to this. Net market borrowings are estimated at Rs. 11.8 lakh crore and the balance is expected to come from small savings and other sources.

FEBRUARY 01, 2023 12:07

Revised Estimates of 2022-23

- Total receipts (other than borrowings): Rs. 24.3 lakh crores of which Net tax receipts are 20.9 lakh crores.

- Total Expenditure: Rs. 41.9 lakh crores of which capital expenditure is Rs. 7.3 lakh crore

- Fiscal Deficit: 6.4% of GDP

FEBRUARY 01, 2023 12:04

Senior Citizens Savings Scheme deposit limit raised

Senior Citizens’ Savings Scheme deposit limit will be raised from Rs. 15 lakh to Rs. 30 lakh.

FEBRUARY 01, 2023 12:04

Azadi ka Amrit Mahotsav Mahila Sammaan Bachat Patra

A one-time new small savings scheme will be made available for a two-year period upto March 2025. This will offer deposit facility of upto Rs. 2 lakh for a tenure of two years with an interest rate of 7.5% with partial withdrawal allowed.

FEBRUARY 01, 2023 12:03

Banking laws being amended

To improve banks’ governance, certain amendments to the Banking Regulation Act and the RBI Act are proposed.

FEBRUARY 01, 2023 12:02

Capacity building in Securities market

SEBI will be empowered to develop, regulate, maintain and impose norms and standards, for education in the National Institute of Securities Market, and to recognize award of Degrees, Diplomas and Certificates

FEBRUARY 01, 2023 12:00

Data Embassy

For countries looking for digital continuity solutions, we will encourage setting up data embassies in the IFSC Gift City

FEBRUARY 01, 2023 11:57

Financial Sector

A revamped credit guarantee scheme is being launched for MSMEs through infusion of Rs 9,000 crore from April 1. This will enable collateral-free borrowings worth Rs. 2 lakh crore. The cost of credit will be reduced by about 1%.National Financial Information repository to be set up. Financial sectors regulators will be requested to carry review of existing regulations. To meet the needs of Amrit Kaal and facilitate optimal regulation of financial sector, public consultation process will be introduced. A comprehensive review of existing regulations will be done and time limits to decide on applications will also be laid down.

FEBRUARY 01, 2023 11:55

Youth Power

We have formulated the National Education Policy, the Finance Minister says coming to the next priority of the Union Budget.PM Kaushal Vikas Yojana 4.0 will be launched to skill lakhs of youth. The scheme will also cover new age courses like drones and 3D printing.30 Skill India International centers will be system across States. Launch of a Unified Skill India Platform is announced by Ms. Sitharaman. To provide stipend to 47 lakh youth in three years, direct benefit transfer under a Pan-India national apprenticeship scheme will be rolled out

FEBRUARY 01, 2023 11:52

Vehicle Replacement

Replacing old polluting vehicles is an important part of greening our economy. I have allocated adequate funds to scrap old vehicles of Centre and State governments The Ministry of Road Transport and Highway had in Sept 2021 instituted final rules for setting up automated fitness testing stations and registered scrapping facilities. The idea was to enable a digital and user-friendly implementation of the scrapping scheme meant to phase out unfit and polluting vehicles in an eco-friendly manner.

FEBRUARY 01, 2023 11:49

Natural Farming

Over the next three years, we will facilitate 1 crore farmers to adopt natural farming. For this 10,000 bio-input resource centers will be set up.‘Mishti’ scheme for mangrove and wetland conversation, and ‘Ámrit Dharohar’ for wetlands, announced by the Finance Minister

FEBRUARY 01, 2023 11:47

Green Growth

National Green Hydrogen Mission will facilitate transition of economy to low-carbon intensity. Our target is to reach annual production of 5MMT by 2030Budget provides Rs. 35,000 crore towards energy Transformation and achieving net zero goals. Green credit programme introduced to encourage sustainable living. The Government had previously stated that investments towards renewables in the last seven years stood at $78.1 billion. As per Govt estimates, the likely installed capacity from non-fossil fuels is expected to be more than 500 GW by 2030 translating to a fall in average emission rate by around 29% by 2029-30, in comparison to 2014-15.

FEBRUARY 01, 2023 11:44

Lab-grown diamonds

Lab-grown diamonds is an emerging sector. To encourage production and reduce import dependency, a R&D grant will be provided to one IIT for five years.

FEBRUARY 01, 2023 11:43

System of unified filing process will be set up

The PAN will be used as a common business identifier for all digital systems of government agencies. This will facilitate ease of doing business and will be implemented with a legal mandate. A system of unified filing process will be set up so that agencies can get data from a common portal as per the choice of those filing returns.

FEBRUARY 01, 2023 11:42

Vivaad se Vishwas 1: Relief for MSME

In cases of failures by MSME to execute contract during COVID, 95% of the forfeited amount, relating to the bid or performance security will be returned to them by govt and undertakings.

FEBRUARY 01, 2023 11:41

Highlights | 11:40 a.m.

- Capital expenditure outlay increased 33% to Rs 10 lakh in FY 2023-24, 3.3% of GDP

- Capital expenditure of the centre budgeted at Rs 13.5 lakh crore

- Outlay PM-Awas Yojna increased 66% to Rs 79,000 crore

- Agriculture credit target raised to Rs 20 lakh crore

- Vishwakarma Kaushal Samman introduced for traditional artisans and craftspeople

FEBRUARY 01, 2023 11:40

National Data Governance Policy

To unleash innovation and research by startups and academia a National Data Governance Policy will be brought up, enabling access to anonymized data.

FEBRUARY 01, 2023 11:38

Centres of excellence for Artificial Intelligence to be set up

For furthering the trust-based governance, we have introduced the Jan Vishwas Bill to amend 42 Central Act. This budget proposes a series of measures .For realizing a mission of Make AI work for India three centers of excellence for Artificial Intelligence to be set up in top educational educational institutions.

FEBRUARY 01, 2023 11:36

Mission Karmayogi

Under Mission Karmayogi, Centre and States are making and implementing capacity-building plans for civil servants. The government has also launched an integrated online training platform, iGOT Karmayogi, to provide continuous learning opportunities for lakhs of government employees to upgrade their skills.

FEBRUARY 01, 2023 11:33

Capital expenditure of the Centre budgeted at Rs. 13.5 lakh crore

The effective capital expenditure of the Centre is budgeted at Rs. 13.5 lakh crore, 4.5% of GDP, Ms. Sitharaman says. I have decided to continue the 50-year interest-free loan to State governments for one year, to incentivize them, with a significantly enhanced outlay of Rs. 1.3 lakh crore. Rs 2.40 lakh crore outlay for railways is highest ever, 9 times more than 2013-14 outlay, says FM.

FEBRUARY 01, 2023 11:32

Infrastructure and Investment

After subdued period of COVID, private investments are growing again. The Budget takes the lead again to ramp up the virtuous cycle of capex. The capital expenditure outlay is being raised again for the third year in a row, by 33% to Rs. 10 lakh crore, which would be 3.3% of GDP. The outlay was increased 35.4% to Rs 7.50 lakh crore in FY 2022-23. It stood at Rs 5.54 lakh crore in the prior year. This will almost be three times the outlay made in 2019-20.Lok Sabha erupts in chants of “Modi Modi”

FEBRUARY 01, 2023 11:30

PM Awas Yojana outlay enhanced by 66% to over Rs. 79,000 crore

Outlay for PM Awas Yojana is being enhanced by 66% to over Rs. 79,000 crore. In the Union Budget 2022-23, the FM had proposed an allocation of ₹48,000 crore towards the government initiative of Housing for All. The Government had promised 80 lakh houses will be completed for the identified eligible beneficiaries of PMAY, both rural and urban.

FEBRUARY 01, 2023 11:27

Reaching the last mile

Building on success of Aspirational District program, we have recently launched the Aspirational Blocks program, covering 500 blocks for saturation of government services.PM-Primitive Vulnerable Tribal Group development Mission is being launched to improve economic conditions of particularly vulnerable groups. Safe housing, clean water, road and telecom connectivity will be provided. An Amount of Rs. 15,000 crores allocated to implement this across three years.38,800 teachers and support staff will be recruited for the 740 Eklavya residential, Ms. Sitharaman says, to schools which are serving 3.5 lakh tribal students.

FEBRUARY 01, 2023 11:24

National Digital Library for Children and Adolescence

A National Digital Library for children and adolescents will be set-up for facilitating availability of quality books across geographies, languages, genres and levels, and device agnostic accessibility. States will be encouraged to set up physical libraries for them at panchayat and ward levels and provide infrastructure for accessing the National Digital Library resources. To build a culture of reading, and to make up for pandemic-time learning loss, the National Book Trust, Children’s Book Trust and other sources will be encouraged to provide and replenish non-curricular titles in regional languages and English to these physical libraries.

FEBRUARY 01, 2023 11:21

Health, Education and Skilling

157 new nursing colleges will be established in co-location with 157 medical colleges established since 2014.Elimination of sickle cell anaemia targeted for 2047New program to promote research and innovation in pharma will be taken up through Centres of Excellence. Will also encourage industry to invest.

FEBRUARY 01, 2023 11:20

Agriculture credit target will be raised to Rs. 20 lakh crore

Now, to make India a global hub for Shree Anna Research, the Indian Institute of Millet Research in Hyderabad will be made into a centre of excellence. The agriculture credit target will be raised to Rs. 20 lakh crore with a focus on animal husbandry and fisheries. The Budget allocation for Ministry of Agriculture and FW was increased to Rs 1.24 lakh crore in FY 2022-23. Further, institutional credit for the agriculture sector scaled Rs 18.5 lakh crore in December 2022, up from Rs 16.5 lakh crore in January 2022.The Govt had also extended the concessional institutional credit availed through Kisan Credit Cards at 4% interest per annum to animal husbandry and fisheries sector as well in order to help them meet their capital needs.

FEBRUARY 01, 2023 11:14

Inclusive Development

The Finance Minister speaks on the first priority: The governent’s policy of Sabka Saath Sabka Vikas has helped many sections including women, SCs, STs, OBCs and other underprivileged sections. Digital public infrastructure for agriculture will be built as an open source, open standard and interoperable public good.An agriculture accelarator fund will be setup to encourage agricultural startups. It will also bring in modern technology to transform agro practices.

VIDEO: India Budget 2023 live | Budget will fulfil dreams of today’s aspirational society: PM Modi

The idea is to offer innovative and affordable solutions to present-day challenges of farmers.We will launch an Atmanirbhar Clean Plant program to boost availabiltiy of disease-free, quality planting material, she says. India is at the forefront of popularizing millets, whose consumption improves food security and the well-being of farmers, the Minister says. We grow several types of Shree Anna, such as Jowar, Raagi, Bajra, Ramdana, Cheena and Saama… These have a number of health benefits and have been an integral part of our food for centuries.

Here is where we share source of knowledge (Life Hacks & Life Style ), Entertainment, Technology, Fashion, E-News and updates all over the world.

Keep on visit our website for more updates