India: HOW TO INVEST IN A MUTUAL FUND 2023. Investing in mutual funds in India is a great way to grow your wealth over the long term.

Table of Contents

India: HOW TO INVEST IN A MUTUAL FUND 2023

Here are the steps to invest in mutual funds in India:

Determine your investment goals

Determine your investment goals: Before investing in mutual funds, you should be clear about your investment goals.

This will help you choose the right mutual funds that align with your financial objectives.

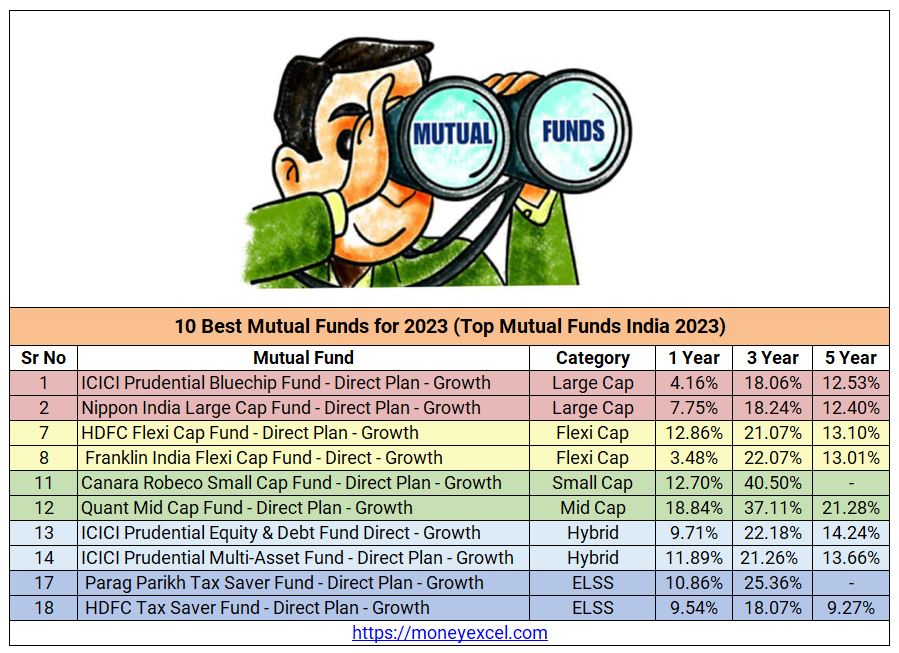

Choose a mutual fund

Choose a mutual fund: There are various types of mutual funds in India, including equity funds, debt funds, hybrid funds, index funds, and others.

You can choose the mutual fund that suits your investment goals and risk tolerance.

Register with a mutual fund company or platform:

Register with a mutual fund company or platform: You need to open an account with a mutual fund company or platform to invest in mutual funds.

Some of the popular mutual fund companies in India include HDFC Mutual Fund, ICICI Prudential Mutual Fund, SBI Mutual Fund, etc.

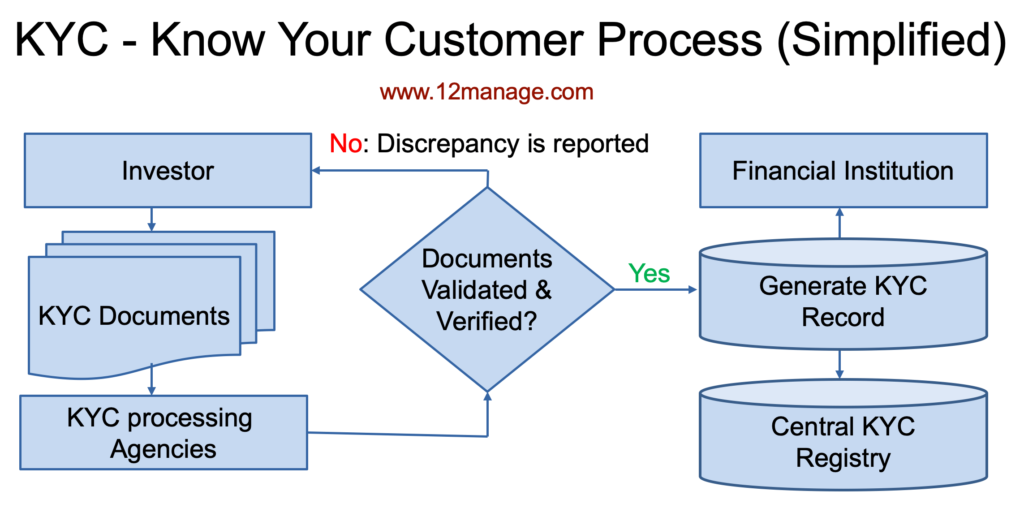

Complete KYC:

Complete KYC: To invest in mutual funds, you need to complete the KYC process. You need to submit your PAN card, Aadhaar card, and other documents to complete the KYC process.

RELATED: VIDEO: 10 Money Secrets You Won’t Learn In School.

Invest online or offline:

Invest online or offline: You can invest in mutual funds online or offline. If you choose to invest online, you can use the mutual fund company’s website or mobile app to invest. You can also invest through a broker or a mutual fund agent.

RELATED: 10 Best countries for investment in Africa – Africa is the future

Monitor your investments

Monitor your investments: Once you invest in mutual funds, you should monitor your investments regularly.

You can track your investments online or through monthly statements sent by the mutual fund company.

What to know when investing in Mutual Fund

- One can invest in mutual funds by submitting a duly completed application form alongwith a cheque or bank draft at the branch office or designated Investor Service Centres (ISC) of mutual Funds or Registrar & Transfer Agents of the respective the mutual funds.

- One may also choose to invest online through the websites of the respective mutual funds.

- Further, one may invest with the help of / through a financial intermediary i.e., a Mutual Fund Distributor registered with AMFI OR choose to invest directly i.e., without involving or routing the investment through any distributor.

RELATED: VIDEO:The FIVE (5) Countries With 50% of All Africa’s Wealth

A Mutual Fund Distributor may be an individual or a non-individual entity, such as bank, brokering house or on-line distribution channel provider.

Note :

As per SEBI Mutual Fund Regulations, all MFDs must fulfil the following two requirements before engaging in sale and/or distribution of mutual fund products, namely

- Obtain the relevant certification of National Institute of Securities Management (NISM); AND

- Register with Association of Mutual Funds in India (AMFI ) and obtain AMFI Registration Number (ARN).

Likewise, before being employed in sale and/or distribution of mutual fund products, employees of MFDs are also required to obtain the relevant NISM certification and register with AMFI and obtain Employee Unique Identification Number(EUIN).

- One may also invest either online mode or via conventional paper based mode through MF Utilities Pvt. Ltd. (MFU) – a technology based shared service platform for MF transactions promoted by the mutual fund industry in respect participating mutual funds. For more information please visit www.mfuindia.com

- One can also buy mutual funds units through NSE – MFSS and BSE – StAR MF just like a company stock. To avail this facility, one must complete a one-time online registration with NSE or BSE, as the case may be. For more information on NSE – MFSS and BSE – StAR MF, please visit www.nseindia.com / www.bseindia.com

KYC – A PRE-REQUISITE BEFORE INVESTING IN MUTUAL FUNDS.

Before investing in a mutual fund scheme, whether through online mode or via conventional paper based mode, one must first complete the KYC process by filling up the prescribed KYC form.

KYC stands for “Know Your Customer” and is a term used for Customer Identification Process as a part of account opening process with any financial entity. KYC establishes an investor’s identity & address through relevant supporting documents such as prescribed photo id. (e.g., Passport, Aadhaar or PAN card) and address proof. KYC compliance is mandatory under the Prevention of Money Laundering Act, 2002 and Rules framed thereunder.

For detailed information about KYC, please visit the section on KYC & UBO

Here is where we share source of knowledge (Life Hacks & Life Style ), Entertainment, Technology, Fashion, E-News and updates all over the world.

Keep on visit our website for more updates